The 8-4-3 Rule and the Snowball Effect

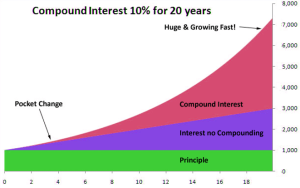

The 8-4-3 rule is a simple yet powerful concept that can help you visualize the exponential growth of your investments over time. But to truly harness its power, you need to understand the concept of the snowball effect.

The Snowball Effect

Imagine a snowball rolling down a hill. As it rolls, it picks up more snow, growing larger and larger.

Similarly, your investments can grow over time, picking up more returns as they compound.

As per this thumb rule, the first 8 years is a period where money grows steadily, the next 4 years is where it accelerates and the next 3 years is where the snowball effect take place.

When you combine the 8-4-3 rule with the snowball effect, you create a powerful force for wealth creation.

For Example

Assume, one having monthly salary of 1.5 Lakhs and he invest 45K( 30% of income) in SIP.

Assume 12% return.

In First 8 years, investments will reach to 72Lakhs

Next 4 years, investments will reach to 1.45 Cr

Next 3 years, investments will grow to 2.27 Cr

Illustration of Snowball effect in Investments

**How to Make the 8-4-3 Rule Work for You**

1. Start Early: The earlier you start investing, the more time your money has to grow. Even small, consistent investments can yield substantial returns over the long term. Aim for investing at least 20-30% of monthly income.

2. Choose the Right Investments: Equity mutual funds are a great option for long-term wealth creation. They offer the potential for high returns, but also come with higher risk. Hence, asset allocation plays a vital role.

3. Stay Disciplined: Stick to your investment plan, regardless of market fluctuations. Consistent investing is key to reaping the benefits of compounding.

4. Review and Re-balance: Regularly review your portfolio to ensure it aligns with your financial goals and risk tolerance. Re-balance your portfolio as needed to maintain your desired asset allocation.

By understanding the 8-4-3 rule and the snowball effect, and by taking action early, you can set yourself up for a financially secure future.

Remember, every small step you take today can lead to significant rewards in the future.

Although investing poses risks, such as market declines, not investing also can be a risk to your financial future.

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Seek professional advice to mitigate such risks and make informed investment decisions. Numbers given in this article are for illustration purpose only.