It is important to change certain bad habits and choose to start off with good ones to improve our life. We should all resolve to apply this to our personal finances as well.

Below are a few financial habits that can be very costly in the long run, and we must try to give up on:

- Chasing Quick Returns:

The allure of quick profits can lead to impulsive decisions and risky investments.

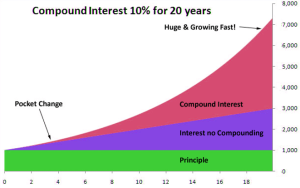

Seasoned investors are always patient concerning their money and they tend to stay away from the madness of the crowd. Like great wine and whiskey, the fruits of investments get only sweeter with time. Hence, make it a habit to ignore the short-term fluctuations in the market and stay focused on the long term.

We should resolve to give up these bad habits and inculcate good ones and make them a way of life.

2.Taking Investment Decisions Based on Tips From Friends And Relatives

Relying on anecdotal advice can lead to poor investment choices.

We all have that set of relatives or friends, who are self-proclaimed investment gurus. Usually, people who have been tracking the markets and investing for many years without any professional knowledge or guidance, believe that they actually ‘know-it-all’, and generously start imparting their knowledge on ‘how you can double your money’ or ‘how investing in the stock market is a gamble and you should invest only in safe asset classes like Gold and Real Estate.’ Often, we get influenced by their views and take their suggestions as and when it comes to personal money matters; we tend to rely on people whom we know and trust.

However, it is very important to differentiate between a qualified Financial Coach and a person who is giving suggestions based on his experience as an investor. Even the most renowned sports persons often rely on coaches to help them reach their peak performance.

- Making Ad-hoc Investments

Simply setting aside some amount as savings is not enough. All investments must be made with a purpose in mind. ie, Goal Oriented investment approach.

Take the help of a qualified financial advisor to list out your life goals and how to Prioritize, Plan (how much you need to save) and Invest (where to invest) to achieve these goals. Periodic reviews will also ensure that you stay on track towards achieving your goals.

- Spending Sporadically and not having a Savings Budget

Impulse purchases and a lack of financial planning can hinder your ability to invest consistently.

Most people spend first and then save and invest what is left. This way of managing cash flows leads to unnecessary expenditure and eventually we land up saving less. We recommend a strategy of first setting aside a portion of your income as savings towards your goals, and then spending the balance amount guilt-free. This will ensure that over a period, you build a sizeable corpus, through steady investments and streamline your monthly expenses. For example, by saving mere Rs. 5,000 per month in equity-oriented investments for long term, you can accumulate a corpus of Rs. 1.62 Crore, over a period of 25 years.

- Panicking During Market Corrections:

It’s natural to feel anxious when the market drops,but selling in panic can lead to significant losses.

Many investors may fear losing their hard-earned money and may panic and sell their investments.

However,this emotional response can often lead to poor investment decisions.

Stick to Your Investment Plan, Develop a well-thought-out investment plan and stick to it, even during market downturns. Avoid making impulsive decisions based on emotions.

“We are what we repeatedly do” Aristotle (384-322 BC)

Credits: Parts of the Blog is from the article published by Amar Pandey, CFP